Learn about BERT-e, our lending robot

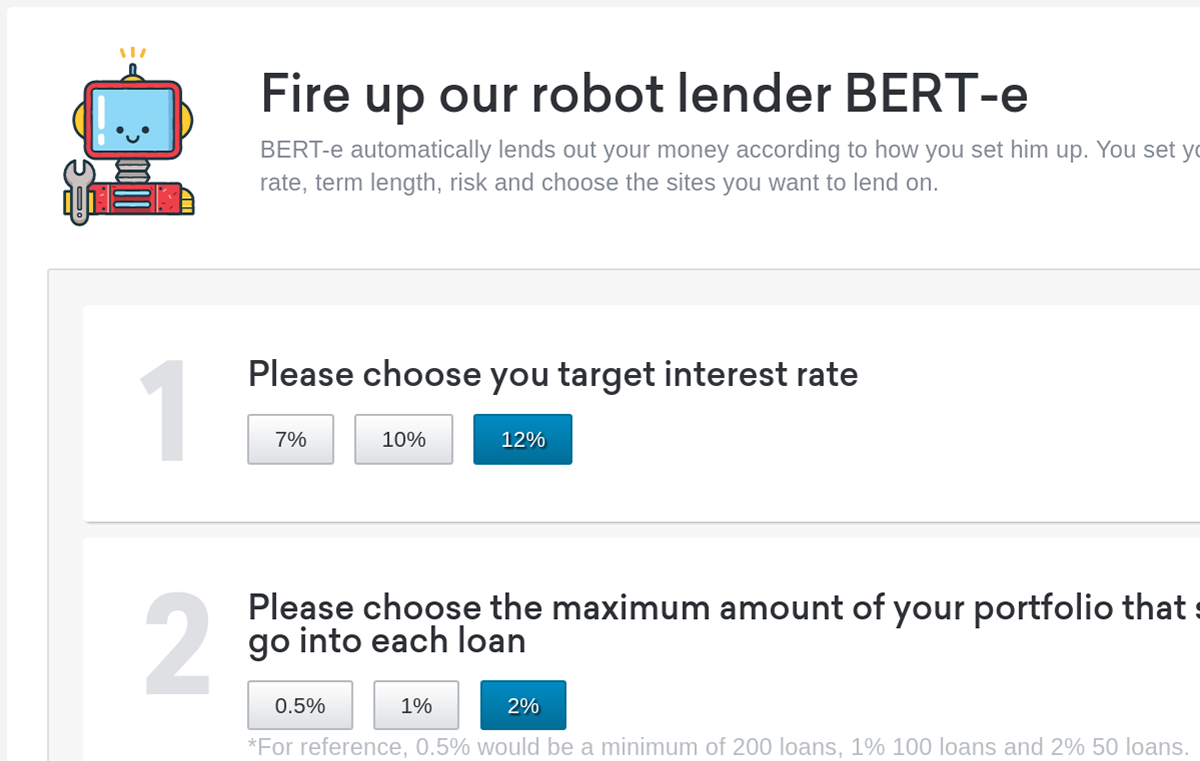

BERT-e is your personal lending robot. If you want to get involved in P2P, but don’t have the time to pick and choose each loan, then BERT-e may be perfect for you.

Designed for the armchair investor, BERT-e will automatically lend out your money to businesses. He’s super simple to set UP. All you need to do is pick your target interest rate, choose which platforms you want to lend to and how much you want going to each loan. Then let BERT-e do the work. You can switch BERT-e off at any time.

Using BERT-e does cost a fee, UP will take 10% of any earnings - this is about 1% of your portfolio. For example, if you lent £1,000, you could earn £100 and pay just £10.00 (assuming you achieve a gross return of 10% pa)

Your money will only be lent to companies on platforms which you give explicit instruction for, which may include Real Estate, Debt and Invoice Factoring. BERT-e is not offering any advice, and is making no guarantee on future returns. You’re capital is at risk.

Learn about BERT-e, our lending robot

BERT-e is a new feature to UP. If you want to get involved in P2P, but don’t have the time to pick and choose each loan, then BERT-e may be perfect for you.

Designed for the armchair investor, BERT-e will automatically lend out your money to businesses. He’s super simple to set UP. All you need to do is select your risk appetite, your level of interest you want to be paid, and what P2P & crowdfunding sites and sectors you feel comfortable with. Then let BERT-e do the work. You can switch BERT-e off at any time.

BERT-e is part of both our crowdISA® and everyday accounts. He comes at no extra cost.

Do note that BERT-e does not cover share-based real estate investments (equity securities) or long-term loans (debt securities). These types of investments are FCA regulated and are not available as part of the BERT-e lending service.